The Three Priorities in Your Budget After Listing Income Are

What is the due date for the deposit of these taxes. What priority are those in your budget shelter food utilities and transportation.

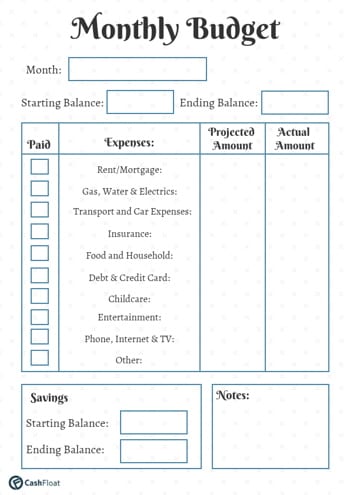

Printable Budget Worksheet Little Us Printable Budget Worksheet Budgeting Worksheets Budget Printables

If your employer offers a matching contribution taking full advantage of it should be your first budgeting priority.

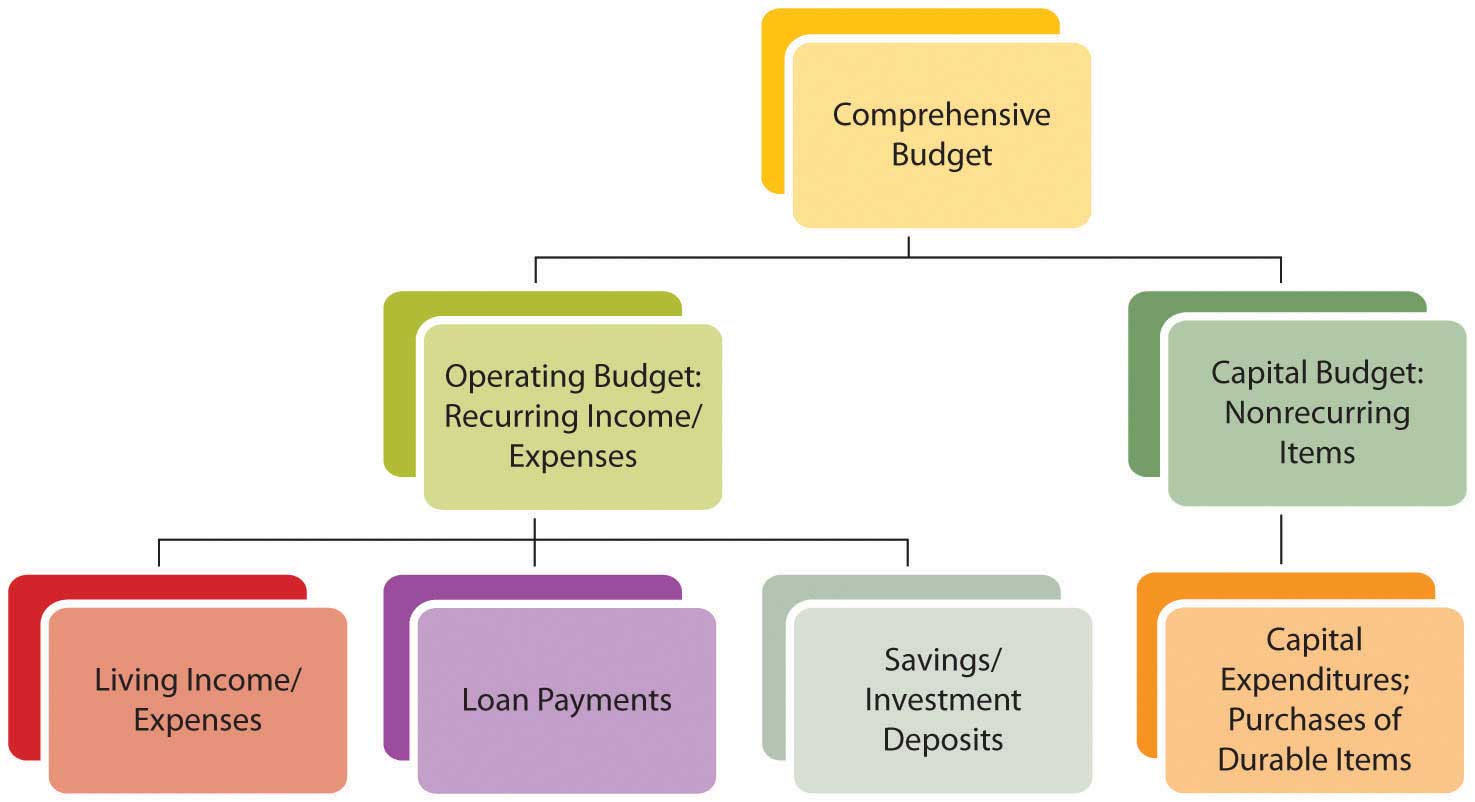

. Income expenses assets and debts to better understand the scope of your financial situation. Your percentages may need to be adjusted based on your personal circumstances. These are expenses that you must pay in order to live and work.

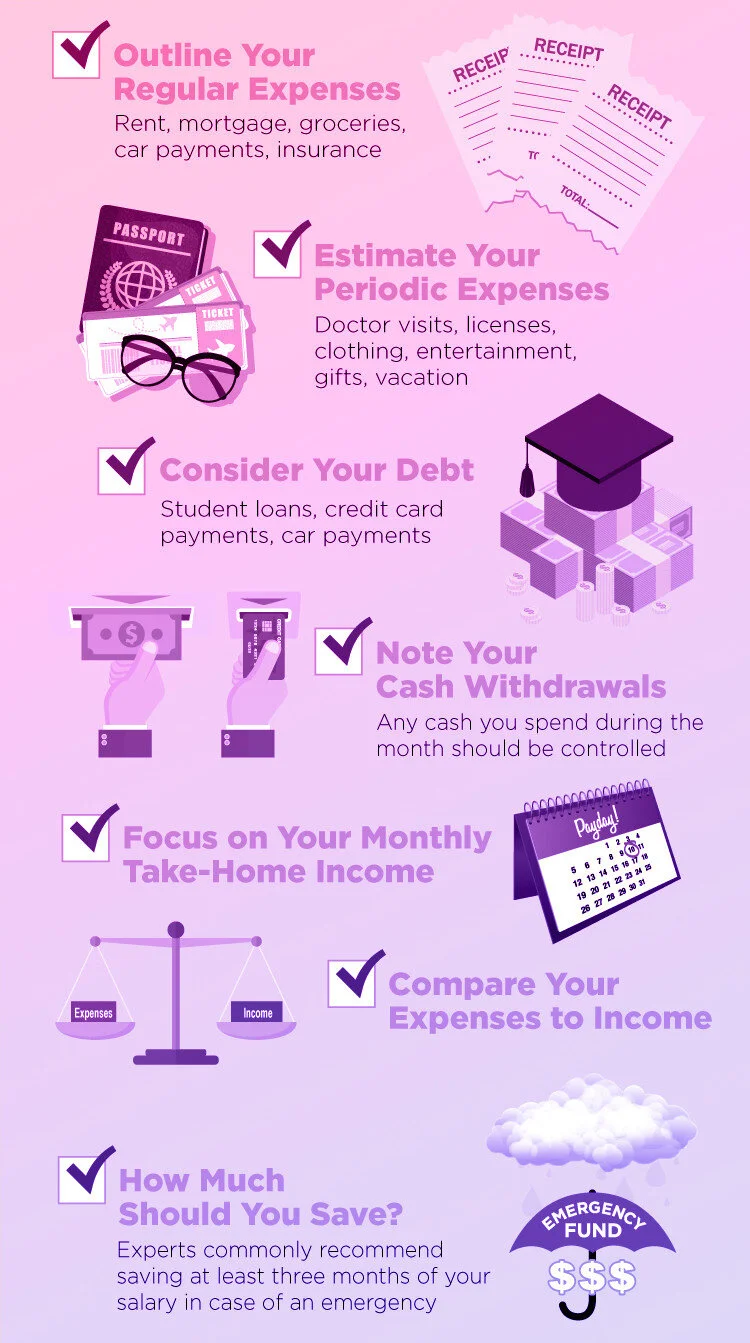

You have to have an emergency fund in case you lose your job get sick or have a major financial expense. To set up a household budget you will need to do three activities. As you reach some of your goals you will need to tweak your budget to place emphasis on your next goals.

List the four walls. Interest on late payment. Most experts say you should have three to six months of.

After three months reevaluate your expenses and set a longer-term budget for maybe six months. It takes about 66 days to form a habit. Suppose the firm pays the loan off with 13 payments left.

Penalty for failure to fully pay employment taxes c. Retirement is ideally a choice but it might be the result of forced unemployment. The three priorities in your budget after listing income are.

- Set priorities and make changes so that your income will be greater than your expenses. Gives you permission to spend. You want to make sure your family has food in.

Over time your priorities might change. Setting priorities will help you control spending so it is. The three priorities in your budget after listing income are.

- List your income. Answers 3 Lol yes why are you asking. Business 22062019 0710 mega29.

The envelope system is especially helpful for expenses like ___. If you cant pay all of your bills and are having a hard time making ends meet these Four Walls should be what you spend your money on first and in this order. NerdWallet recommends the 503020 rule which breaks down your after-tax monthly income into three budget categories.

Budgets should accurately reflect the services being provided. - List your expenses. Budget Priority 3 A Debt-Free Existence.

Given the following information calculate the savings ratio. Add your answer and earn points. But long-term disability insurance typically doesnt kick in until three months or more after the event that caused a disability.

Penalty for failure to make timely deposits. Liabilities 25000 liquid assets 5000 monthly credit payments 800 monthly savings 760 net worth 75000 current liabilities 2000 take-home pay 2300 gross income 3500 monthly expenses 2050 multiple choice 240 306 3478 3379 2171. The 503020 rule of thumb is a guideline for allocating your budget accordingly.

IDENTIFY PRIORITIES AND SET YOUR GOALS. Job layoffs age discrimination family care obligations and health issues can force people into early retirement. Disability insurance is designed to replace some of your lost income on a short- or long-term basis.

In addition finished goods. - List your income. Because of the specialized manufacturing process employed considerable workminusinminusprocess and raw material inventories are created.

- Set priorities and make changes so that your income will be greater than your expenses. Round your answers to the nearest cent. - List your expenses.

If you wanted to build your emergency fund to have three months worth of expenses and you reached that goal you can divert some of the money you were using to build your emergency fund quickly. The average inventory levels are 1152000 and 2725000 respectively. If you have a robust emergency fund you may not need to worry about short-term disability coverage.

Below is a list of budget considerations outside the necessities. Setting priorities will help you control spending so it is. These techniques can be used independently or in combination depending on the type of budget implemented.

The three priorities in your budget after listing income are 4 answers Question. The three priorities in your budget after listing income are - 25286592 dbrown21225 dbrown21225 10282021 Business College answered The three priorities in your budget after listing income are 1 See answer Advertisement Advertisement dbrown21225 is waiting for your help. The third priority when you make a budget should be to allocate funds to pay off other debts that are unrelated to the mortgage or the car payment.

Assume that no deposit was made until april 29. The budget setting process is crucial for effective budgetary control. Enderson corporation is a supplier of alloy ball bearings to auto manufacturers in detroit.

We dealt with each of those in step 1. It was popularized by Elizabeth Warren and her daughter Amelia Warren Tyagi. Listing your expenses is important because it allows you to see where your money goes.

There are several budget setting techniques that can be used for both expenditure and income budgets. The healthy pantry bought new shelving and financed 7300 with 36 monthly payments of 26765 each. Assume a 365-day year in your computations.

Next Answers Answers 1 Ithink its b hope it. False hope it. 50 to needs 30 to wants and 20 to your financial goals.

The three priorities in your budget after listing income are ___. Compute the following penalties. It should come after giving and saving but come before all.

Thats just over two months so even if you only make it through your three-month budget you will have formed some great budgeting habits. To set up a household budget you will need to do three activities. First organize and consolidate all of your financial info.

Specific categories are important to consider when creating a budget so you can ____. Listing your expenses is important because it allows you to see where your money goes. Next identify your priorities.

:max_bytes(150000):strip_icc()/how-to-make-a-budget-1289587-Final2-updated-17bbe4528d38430ca42f4138f599ed56.png)

Try This Simple 5 Category Budget

How To Budget Budget Categories And Methods Clever Girl Finance

How To Build A Budget Infographic

5 Budgeting Tips For Low Income Earners Cashfloat

Plan Your Meal Plans And Keep Kitchen Inventory Easily With The Ready To Print Meal Planner In Floral Style De Project Planner Printable Print Planner Planner

Monthly Expense Tracker Template Printable Monthly Budget Etsy In 2020 Monthly Budget Printable Expense Tracker Budget Planner Template

The Ol 50 20 30 Budget Rule Really Works Budgetry

Budget Bootcamp 3 Step Action Plan To Take Control Of Your Finances Dani Johnson How To Plan Action Plan Budgeting

Pin On Ide Hu Tles I Want It All

Budgeting Tips For Beginners How To Budget In 2022 Savvy Budget Boss

Study Session Planner For School Work And Assignments Study Sessions Planner Study Planner Planner

States Can Use Snap And Medicaid To Reach Most Of 12 Million People Not Receiving Automatic Stimulus Payments Medicaid To Reach Budgeting

Let Other Bloggers Learn From Your Income Reports While You Learn From Theirs The Billionaire Blog Club Blogging Courses Writing Blog Posts Blog

How To Budget Budget Categories And Methods Clever Girl Finance

Printable A5 Budget Planner Printable Financial Planner Etsy Uk Financial Planner Printables Printable Planner Budget Planner Printable

A Simple Worksheet To Help You Prioritize What S Important To You And Tweak Your Import Money Habits Budgeting Finances Money Saving Plan

Priority Matrix Google Search Priorities Life Goals Quotes Matrix

Comments

Post a Comment